What is NetSuite Account Reconciliation Software?

NetSuite is a cloud-based Enterprise Resource Planning (ERP) software that provides a range of business management, financial tools and reporting tools fo business organizations. The platform's module framework allow organizations to add, remove and customize modules to adhere to the business needs. Modules include accounting, finance, inventory management, reporting and customer relationship management (CRM).

Account reconciliation is a critical accounting process that involves comparing financial records and transactions in a company's general ledger with external sources, such as bank statements, credit card statements, and other financial documents. Account reconciliation ensures transactions match and are accurate. A crucial process for identifying discrepancies, errors, or fraud and maintaining the financial integrity of a business organization.

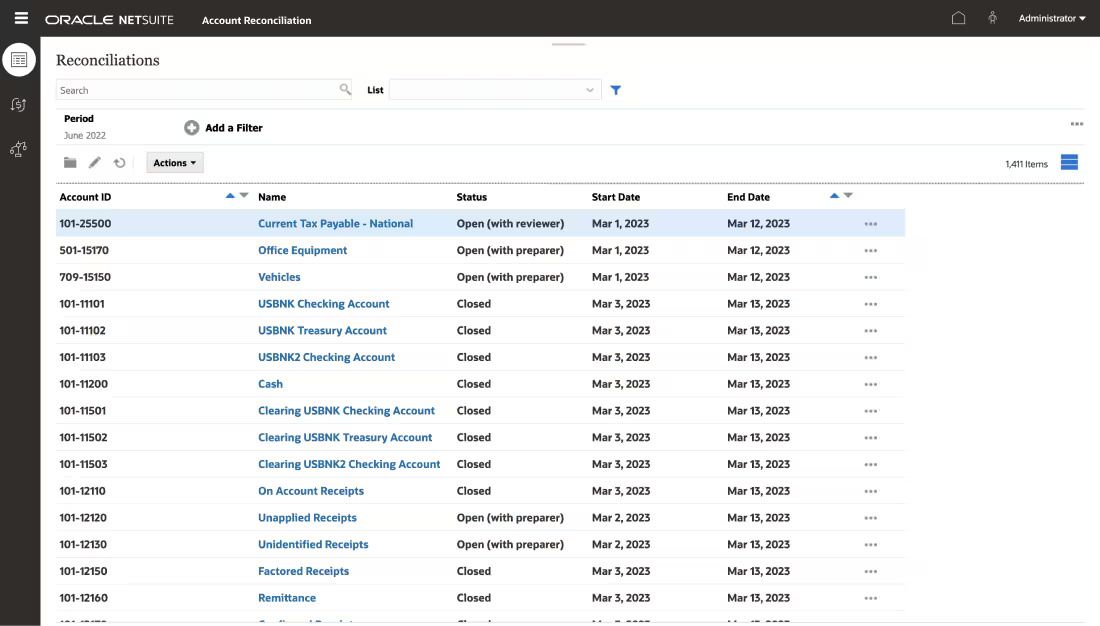

NetSuite Account Reconciliation software allow general ledger account to automatically reconcile. Reconciliation of transactions include bank reconciliation, credit card transactions, intercompany transactions, accounts payable, accounts receivables and customer invoice to PO matching. All reconciliation in one centralized workspace in the cloud.

With NetSuite Account Reconciliation, manual tying and matching transactions are eliminated minimizing errors so that teams can focus on planning and budgeting, high risk reconciliation and strategic work that help organizations grow and become more profitable.

Automate and Standardize Your Reconciliation Process

NetSuite Account Reconciliation eliminates valuable time spent downloading data from 3rd party systems, aggregating details in decentralized spreadsheets, manually reviewing account balances, and using complex spreadsheet formulas to match and reconcile transactions.

Enhance Control and Visibility

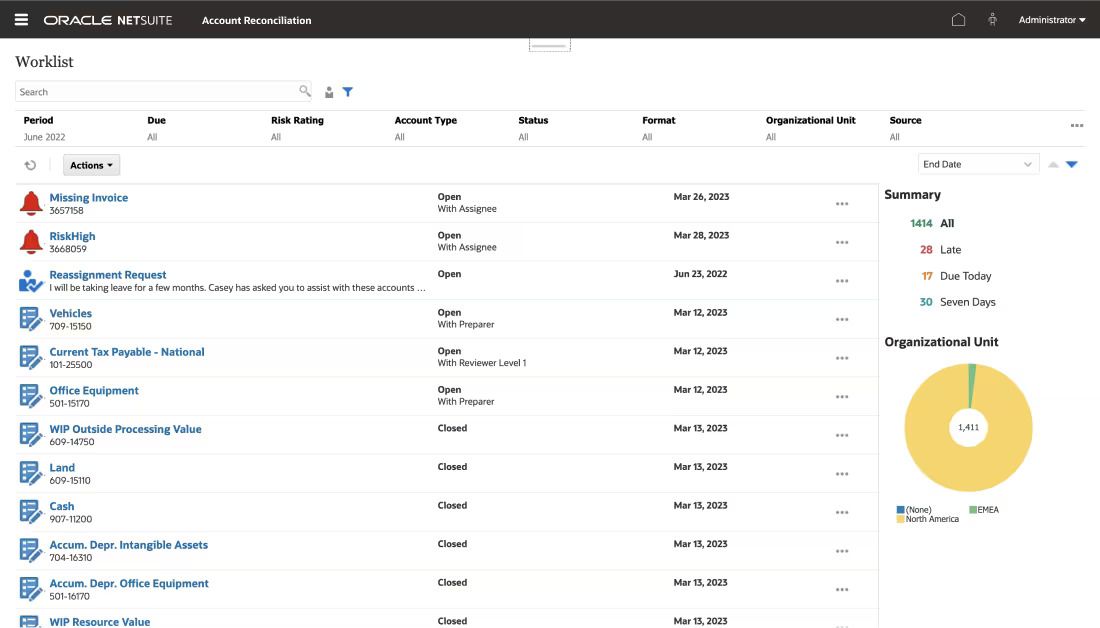

NetSuite Account Reconciliation cloud based solution allows users to view the status of all reconciliations in one place. Real-time dashboards and customizable purpose-built reports provide visibility into the reconciliation status of each account, showing preparers, reviewers, and sign-off dates. User roles allow NetSuite administrator to give proper permissions to each user based on their responsibilities.

NetSuite Account Reconciliation Benefits

NetSuite Account Reconciliation cloud software benefits include:

- Single Solution. Manage and view the status and details of each account with balance comparisons, preparers, reviewers, and sign-off dates all in the cloud.

- Close Faster. Standardize and automate account reconciliations and transaction matching.

- Speed Transaction Matching. Fully automate time-consuming, repetitive reconciliations, such as zero-balance, low-value, or low-risk reconciliations, based on rules you set.

- Strengthen Internal Controls and SOX Compliance. Easily access archived electronic copies of supporting documentation at the account level.

- Financial Statement Accuracy. Reconciling GL accounts ensures any discrepancies or omissions in financial records are caught, reducing the risk of financial misstatements.

NetSuite Account Reconciliation Features

NetSuite Account Reconciliation allows users to work directly with NetSuite general ledger (GL) entries. Automatically match transactions and reconcile line items, ensuring data integrity, accuracy, accessibility and efficiency.

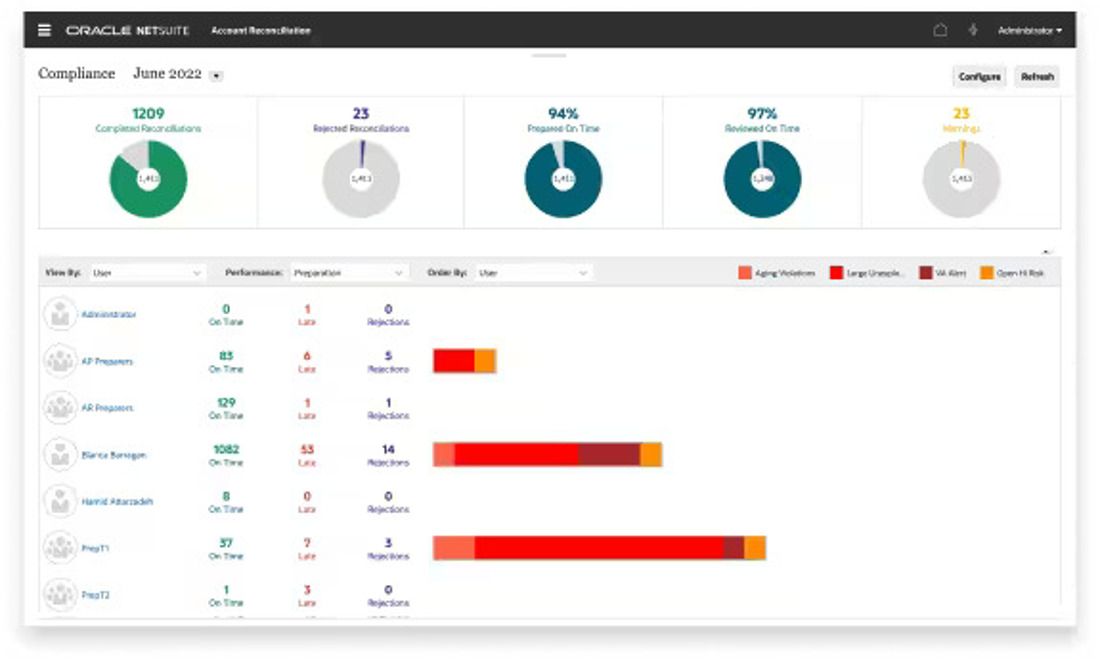

Reconciliation Compliance

Keep the team on track with approval workflow that sets the process and proper approvals that capture evidence of signoffs and user email notifications. NetSuite Account Reconciliation ensures accounts are properly reconciled using the correct format, with complete justification and logic behind any adjusting entries.

- Automate reconciliations. Direct integration with NetSuite transactions allows you to further automate reconciliations for bank accounts, credit card transactions, intercompany transactions, accounts payable, accounts receivable, and similar accounts. Drill down and back to transaction level entries with NetSuite. Allowing accountants to easily address any reconciling issues and items.

- Flexible formats and templates. NetSuite gets any organization started quickly with prebuilt formats and templates based on industry best practices. In addition, your organization or a qualified NetSuite consulting company like Gerard Gibney from Redhill Business Analytics can create custom formats to address your unique requirements.

- Audit support and compliance. Audit support provide evidence for reconciliation for auditing purposes and logs application events. The secure repository ensures global auditability. Evidence is logged in the NetSuite Account Reconciliation system to meet your compliance requirements.

- Flux analysis. Reporting and analysis provides an explanation for balance changes over a given time period, whether it’s a month-over-month, quarter-over-quarter, or year-over-year comparison.

Transaction Matching

Transaction matching supports balance comparison reconciliation processes, including intercompany, subledger, credit card, and bank reconciliations. Dashboards for Operational and compliance show which reconciliations are complete, open, or late and list the responsible party as well as variance details and commentary.

- High-volume transactional reconciliations. The auto-match engine matches millions of transactions in minutes and directly integrates with period-end reconciliations.

- Auto-suggested matching. The intelligent auto-match feature speeds up the transaction-matching process by suggesting matches that you can accept or discard.

- Matching rules. Matching rules provide a flexible rules for individual transactions or groups of transactions, such as one-to-one, many-to-one, and many-to-many matches.

- Complex reconciliations. Complex and volume reconciliation is a breeze with unlimited data sources and unlimited attributes per data source. Sources can be defined to support the most complex reconciliations.

Close Management

Business organization accountants can close books faster and with more accuracy by managing and monitoring every aspect of the close process.

- Schedule. Assign tasks and ensure they are executed in the proper sequence.

- Monitor. Access the status of every close task and its dependencies from a single dashboard, with the ability to drill down by user to identify any potential bottlenecks.

- Workflow. Prebuilt customizable workflows simplify the close process, automating tasks such as task assignments, data validation, approval routing, and notifications.

- Automated Calendars. Calendars automatically roll forward from the prior-year reporting, eliminating the need for manual adjustments.

Conclusion

With NetSuite Account Reconciliation cloud based software, organizations can streamline their financial processes, reduce the risk of errors, and ensure the accuracy and integrity of their financial data. Proper account reconciliation leads to improved financial reporting, better informed decision-making process and greater financial control within the business organization.

Want to Learn More?

If you would like a free consultation please contact Gerard at Redhill Business Analytics via email.