Say Goodbye to Manual Reconciliation Nightmares, automate with Oracle Accounts Reconciliation.

In this article, I will explain how ARCS can help you with two common types of reconciliations: balance sheet reconciliations and bank reconciliations.

Automate with Oracle Cloud EPM Accounts Reconciliation

Are you still struggling with manual accounts reconciliation using spreadsheets? Do you spend hours matching balances and transactions across different sources? Do you lack visibility and control over your reconciliation process? Imagine a world where you can reconcile your accounts in minutes, not hours or days. Where you can collaborate with your team seamlessly and securely. Where you can monitor your reconciliation performance and compliance at a glance. That's the world of Oracle ARCS, a cloud service. It also integrates with various data sources and systems, reducing the dependency on IT support and resources.

Account Reconciliation in Oracle Cloud EPM offers a range of benefits

- Close faster by automating reconciliations: You can use rules and thresholds to identify and reconcile low-risk accounts automatically, without human intervention. This can help you focus on the high-risk accounts that require more attention and analysis.

- Save time and increase accuracy by automating complex reconciliations: You can use transaction matching to compare transactions from different sources and find matches based on predefined or custom criteria. This can help you reduce manual work, avoid errors, and resolve discrepancies faster.

- Automate journal entries to resolve variances and meet compliance needs: You can use journal adjustment to create and post journal entries directly from Account Reconciliation to your general ledger system. This can help you correct variances, maintain audit trails, and comply with accounting standards.

- Make reconciliations part of your close system to speed up your close: Account Reconciliation is integrated with other Oracle Cloud EPM applications, such as Financial Consolidation and Close and Narrative Reporting. This means you can access and share data seamlessly across the close process, without having to export or import data manually.

- Use a solution, not a toolkit, so finance does not have to rely on IT: Account Reconciliation is a cloud-based solution that can be configured and maintained by finance users, without requiring IT support. You can easily set up rules, formats, profiles, workflows, and reports to suit your business needs.

Balance Sheet Reconciliations

Balance sheet reconciliations are essential for ensuring the accuracy and completeness of your financial statements. They involve verifying that the balances in your general ledger match those in your sub-ledgers or other external sources. However, doing this manually can be tedious, time-consuming, and error prone. You must collect data from multiple sources, compare them line by line, identify and resolve discrepancies, document evidence, and track progress. With Oracle ARCS, you can automate this process using predefined rules and workflows. Oracle ARCS can automatically match balances based on criteria such as account number, Entity, currency, date range, tolerance level, etc. It can also flag exceptions for manual review or adjustment. Rules and process can be customized based on organization needs.

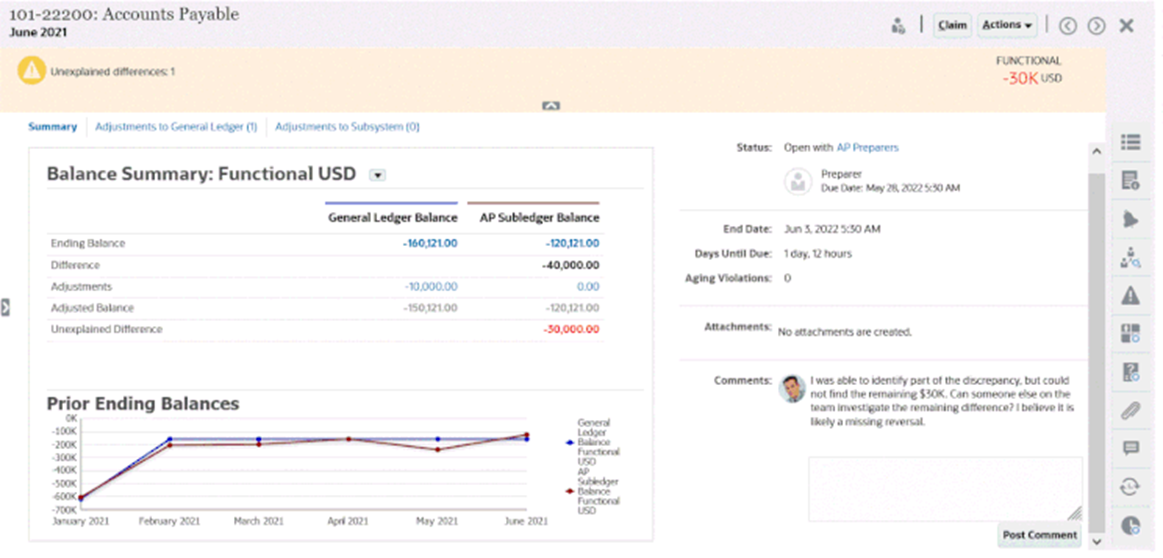

The Accounts Payable Reconciliation dashboard is a user-friendly tool that helps you compare the balances of your general ledger and accounts payable subledger, identify and resolve any discrepancies, and monitor the progress and status of your reconciliations. The dashboard consists of four main panels:

The Unexplained Difference panel shows you the amount of difference between the general ledger and accounts payable subledger balances that has not been explained by any adjustments or transactions. On the upper right, the unexplained difference is always showing so that you can focus on getting that difference down to zero. Example of an unexplained difference of $100,000. of the unexplained difference at top right of Panel

The Balance Summary Numbers panel shows two columns for General Ledger Balance and Accounts Payable Subledger Balance. If you click on the adjustments number or the tab, you can see a detailed list of the transactions that have been made to reconcile the balances. You can also create new adjustments or edit existing ones from this panel.

The Graph panel displays the trend over time of the previous reconciliations. New reconcilers can see if they are in the range that was previously achieved. Existing users can see trends and figure out if there are new issues to address based on those trends. You can also filter the graph by different criteria, such as period, ledger, or business unit.

The Right Hand Side panel contains key metrics for the reconciliation, such as who owns it, when it’s due, and any violations. You can also see the most recent attachments and comments that have been added to the reconciliation. You can use this panel to communicate with other users, upload supporting documents, or change the status of the reconciliation.

The Accounts Payable Reconciliation dashboard is a powerful tool that simplifies and streamlines the reconciliation process. By using this dashboard, you can ensure that your accounts payable balances are accurate and consistent with your general ledger, and that you have a clear audit trail of your reconciliations.

Bank Reconciliations

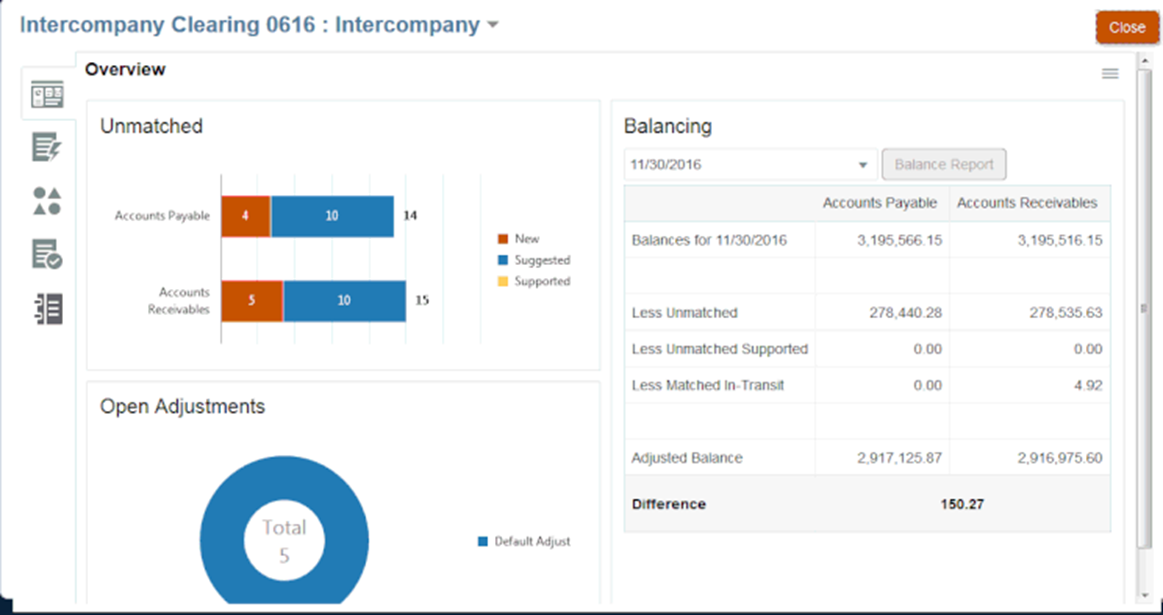

Bank reconciliations are another critical type of reconciliations that involve matching cash transactions between your bank statements and your cash accounts in your general ledger. Again, doing this manually can be challenging especially if you have multiple bank accounts across different currencies or regions. You must download bank statements from various sources, format them into a common structure, import them into spreadsheets compare them with cash transactions, identify differences, reconcile them and document evidence. With ARCS Transaction Matching module, you can simplify this process using automated matching rules. ARCS can automatically match transactions based on attributes such as amount,date,reference number,description it can also handle complex scenarios such as one-to-many,many-to-one,many-to-many,partial matches and cross-currency matches.

Oracle ARCS provides a user-friendly interface for reviewing matching results resolving exceptions adjusting entries creating journals posting entries etc. You can also leverage analytics dashboards reports alerts notifications etc. to monitor manage optimize your bank reconciliation process.

The Balancing panel displays how the sources match up as of a chosen date and you can see more information about the transactions in each category by clicking on them in the Balancing panel.

Oracle ARCS Real-time Dashboards

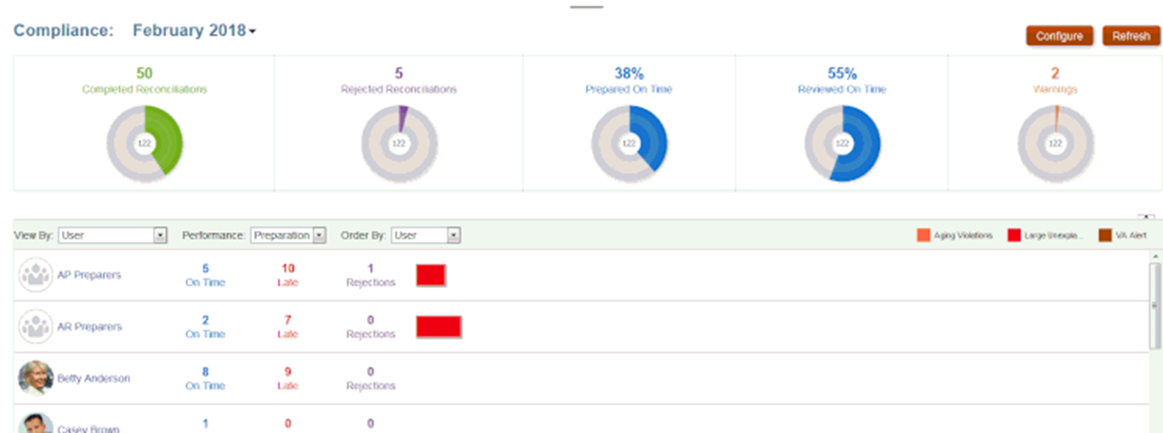

Through dashboards and reports, Oracle ARCS provides real-time visibility into the status of your reconciliations. You can track performance metrics like completion rate, aging analysis, variance analysis, and so on.

The Compliance dashboard displays a summary of the reconciliation status for each period, as well as a breakdown by business unit, account type, and risk level. You can see at a glance which reconciliations were done on time, which were late, and which had issues such as debit/credit violations or aging violations. You can also drill down into the details of each reconciliation to see the reasons for rejection or risk flags.

Conclusion

Accounts reconciliation is an important but frequently overlooked aspect of financial close management. By utilizing Oracle Account Reconciliation Cloud Service (ARCS), you can transform your accounts reconciliation process from a manual labor-intensive exercise to an automated streamlined efficient one. Oracle Account Reconciliation Cloud Service (ARCS) provides regular updates and enhancements that are applied automatically without interfering with existing functionality. Additionally, these updates do not require IT involvement. Oracle ARCS users can take advantage of the most recent features and best practices.