Predictive planning and predictive analytics use statistical techniques to model and predict the outcome of events based on historical data. Create multiple plans to compare and validate forecasts based on historical data predictions.

Predictive models in business, can identify patterns and relationships from historical transactional data. Patterns and relationships help identify the probabilities of events, risks and opportunities.

Predictive models provide predictive scores or probabilities. Predictive planning and predictive analytics are used in fields like marketing, financial services, telecommunication, retail, insurance, travel, health care, pharmaceutical and social networking.

The most widely known application of predictive planning is a consumer's credit score!

Oracle Cloud and Predictive Planning

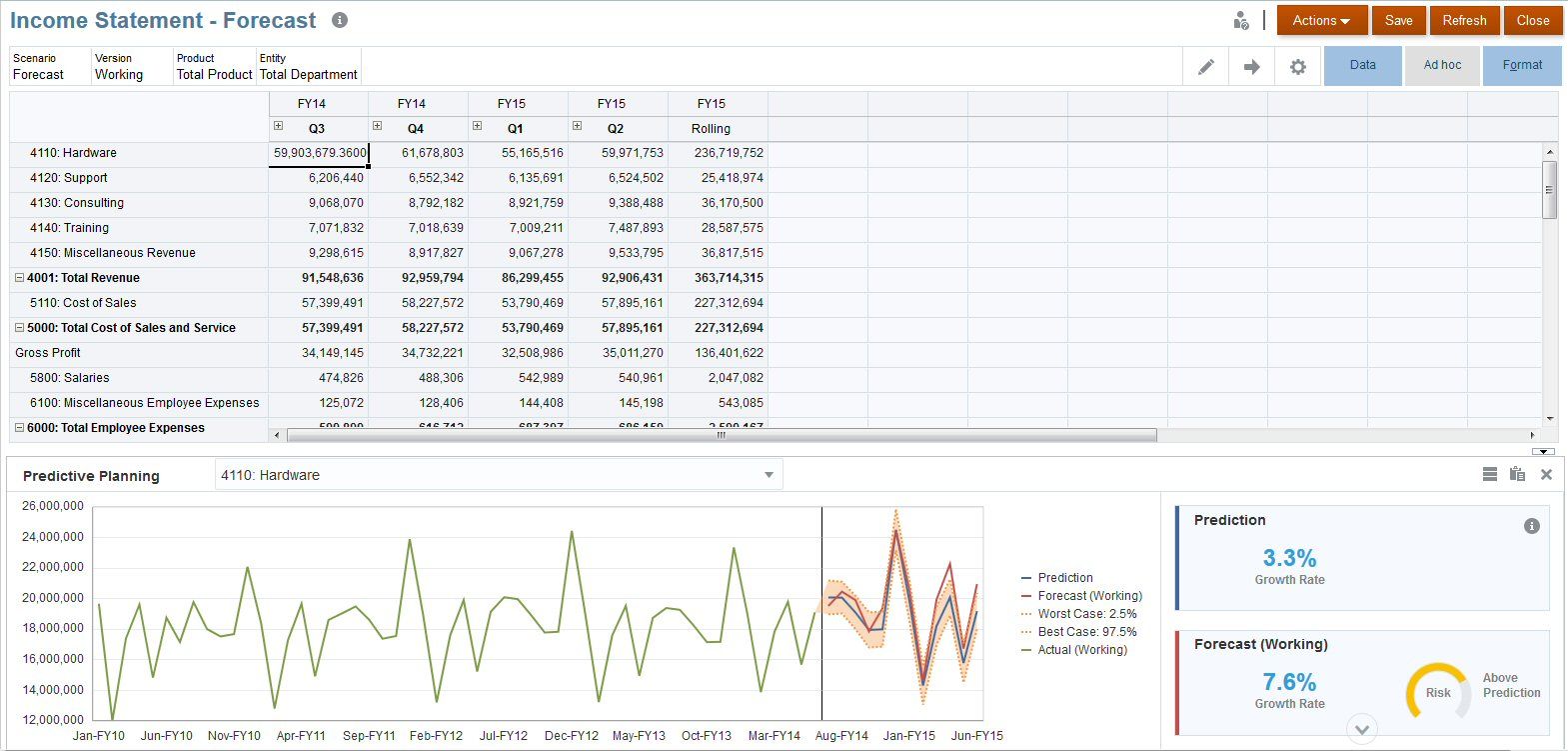

Oracle Cloud provides a Predictive Planning with EPM Standard and EPM Enterprise applications for Custom and Module application types. Predictive Planning uses sophisticated time-series forecasting techniques to create new predictions or validate existing forecasts that were entered into Planning using other forecasting methods.

Predictive planning also allows for the importing of data to create forecasts. You can compare and validate plans and forecasts based on the predictions. For a more accurate and statistically-based forecast, you can copy prediction values and paste them into a forecast scenario for your plan.

Use Historical Data to Drive Out Forecasts

The amount and quality of available historic data significantly impacts the accuracy of predictions. Providing a ratio of at least three times the amount of historical data provides the best results. Predictive Planning can detect missing values in the historical data, filling them in with interpolated values, and scans for outlier values, normalizing them to an acceptable range. If there are too many missing values or outliers in the data a warning message is displayed.

Predictive Planning Forecasting and Statistical Descriptions

Predictive Planning uses complex statistical methods to analyze the structure of the data. Some of the statistical methods used to predict futures values are:

- Classic Time-series Forecasting

- Classic Nonseasonal Forecasting Methods

- Single Moving Average (SMA)

- Double Moving Average (DMA)

- Single Exponential Smoothing (SES)

- Double Exponential Smoothing (DES)

- Damped Trend Smoothing (DTS) Nonseasonal Method

- Classic Nonseasonal Forecasting Method Parameters

- Classic Seasonal Forecasting Methods

- Seasonal Additive

- Seasonal Multiplicative

- Holt-Winters’ Additive

- Holt-Winters’ Multiplicative

- Damped Trend Additive Seasonal Method

- Damped Trend Multiplicative Seasonal Method

- Classic Seasonal Forecasting Method Parameters

ARIMA Time-series Forecasting Methods

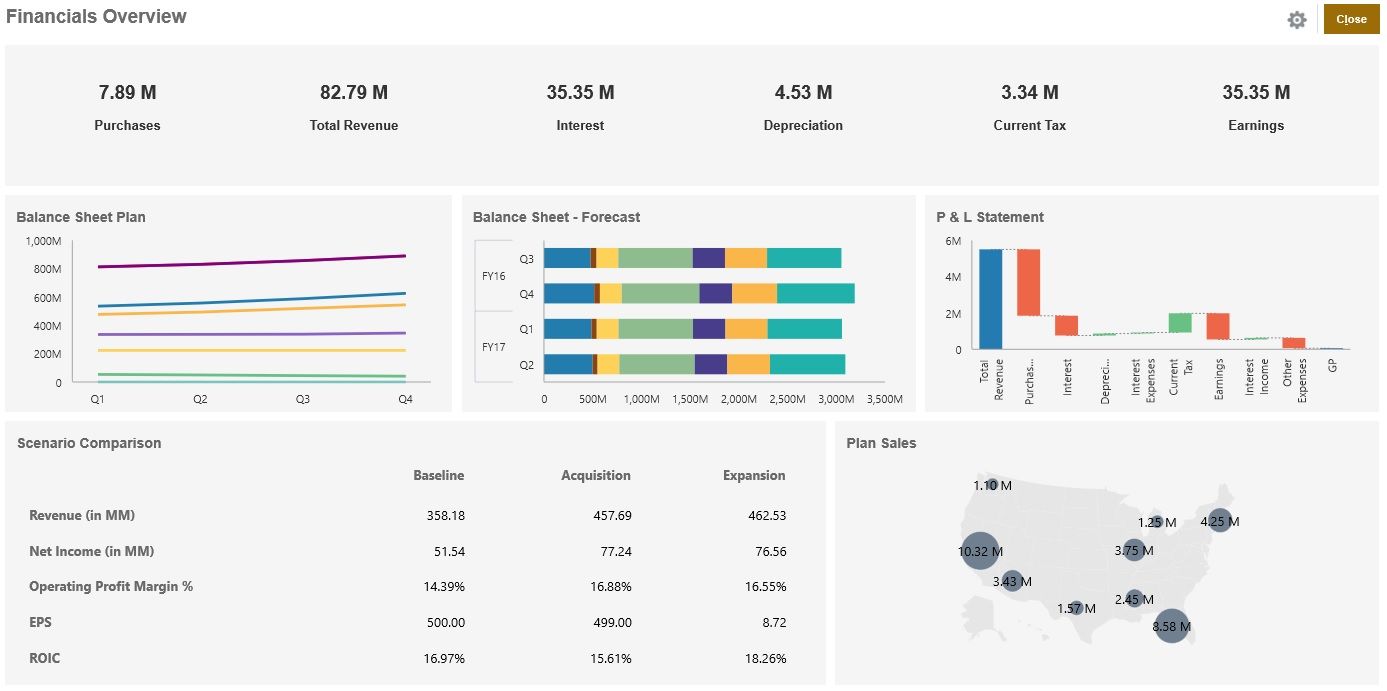

New Financial Dashboard

Want to Learn More?

If you would like a free consultation please contact Gerard at Redhill Business Analytics via email or the contact form below.