Accounting teams spend countless hours reconciling transactions on a weekly, monthly or quarterly (possibly even yearly) basis. Given a company's finite resources, this important and necessary activity consumes a company's personnel time when done manually. Using the right technology will free up accounting resources and minimize manual errors, increasing efficiency and accuracy.

In addition, inaccurate or untimely account reconciliation is an obstacle to proper planning and budgeting. Directly effecting a company's ability to forecast, budget and plan for the coming quarters and year. If your company has transactions in spreadsheets and requires manual transaction reconciliation this increases the risk of inaccuracy in financial statements and delaying financial close.

Summary

Issues:

- Account Reconciliation is Late or Delayed

- Low Confidence in Financial Reports

- Financial Control and Compliance Issues

Solution:

Automate Account Reconciliation with Netsuite Account Reconciliation (we can help)

Three Symptoms Your Company has Outgrown Basic Tools like Spreadsheets

1. Account Reconciliation is Always Late or Delayed

The more steps and personnel involved in the reconciliation process increases time spent on transaction reconciliation, the potential for errors in data entry and errors in manual reconciliation of transactions. Manually reviewing documentation and probing spreadsheets with thousands for rows is a painstaking endeavor with many perils for errors in reconciling transactions. This increases exponentially if moving data between systems with little capabilities if any to trace back to original transaction.

Matching transaction from multiple source manually can contribute to general ledger accounts not reconciling at all. This approach increase the time spent locating, uploading and reconciling transactions and increases the necessary time for accounting leadership to find status, ensure transparency, resolve discrepancies and meet with staff.

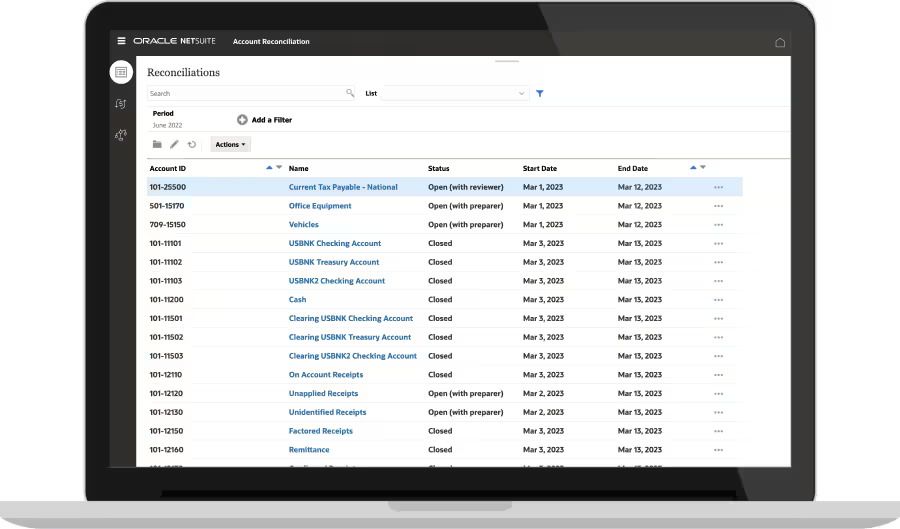

Netsuite Account Reconciliation can automate the once manual, repetitive, time consuming process of account reconciliation for all transactions from various sources. Potential anomalies and discrepancies are flagged by the system. Companies can create flexible reconciliation rules that speed up the process and automate low-risk and low-value transaction without human intervention.

2. Errors and Low Confidence in Financial Reports

While using spreadsheets is convenient it leads to many issues like missing transactions, ensuring that transactions are reconciled correctly and the capability to peer review for quality assurance.

A slow manual process that is error prone can lead to financial uncertainty, delaying the financial close process and misreporting financial results. All that can contribute to damaging a company's, accounting/finance department's and leaderships' reputation. All unnecessary risks given today's technology.

Today's technology can provide a "single source of truth" or centralized accounting solution. The centralized solution can increase confidence in financial reports by increasing transparency, ability to retrace transaction reconciliation and enforcing a financial controls process.

Netsuite Account Reconciliation is a Netsuite ERP module that seamlessly integrates with Netsuite. All general ledger accounts, balances and transactions and transaction matching are all stored in a single repository. Netsuite ERP also stores all documentation in one place so staff, managers, leadership and auditors can easily access all documentation and transactions, eliminating the need to meet with staff and collect documentation from different sources. This reduces the need for meetings, omissions of data, accounting mix ups or overlooking certain data. Improving the accuracy and timeliness of financial recording and the financial close process.

3. Compliance and Financial Control Issues

Accounting teams that reconcile transaction manually for account reconciliation increase risk of inaccuracies causing questions about integrity of financial statement, increase the risk of fraud and compliance issues.

Financial control workflows are also manual and increase the need for the accounting team to coordinate the different stages for the preparer, reviewer and final approver. Manually reconciling transactions and the manual enforcement of financial controls workflow in the end increases time spent, increases money spent and decreases visibility in the process.

Netsuite Account Reconciliation has a secure document repository feature ensuring reconciliations are not lost or missing and provides global auditability. The Netsuite Account Reconciliation solution logs proof of reconciliations that meet financial compliance and financial control requirements.

Netsuite Account Reconciliation

NetSuite Account Reconciliation is a flexible, scalable and easy to use solution for companies of all sizes that enables accounting teams to produce more accurate and timelier financial statements, accelerate the financial close and meet financial compliance requirements.

In addition to more accurate, timelier and financial compliant financial statements Netsuite Account Reconciliation enables companies to redeploy accounting personnel from time consuming, repetitive and error prone activities to focus on higher level accounting needs.

Want to Learn More?

If you would like a free consultation please contact Gerard at Redhill Business Analytics via email, Linked-In or the contact us page.